Bitcoin collapsed 6.5% in minutes after reaching $ 28.4K on sale

Bitcoin (BTCIt reached an all-time high of $ 28,400 before smashing thousands of dollars on December 27 – the latest chapter in the trading frenzy of Christmas.

The price of BTC drops $ 1900 in minutes

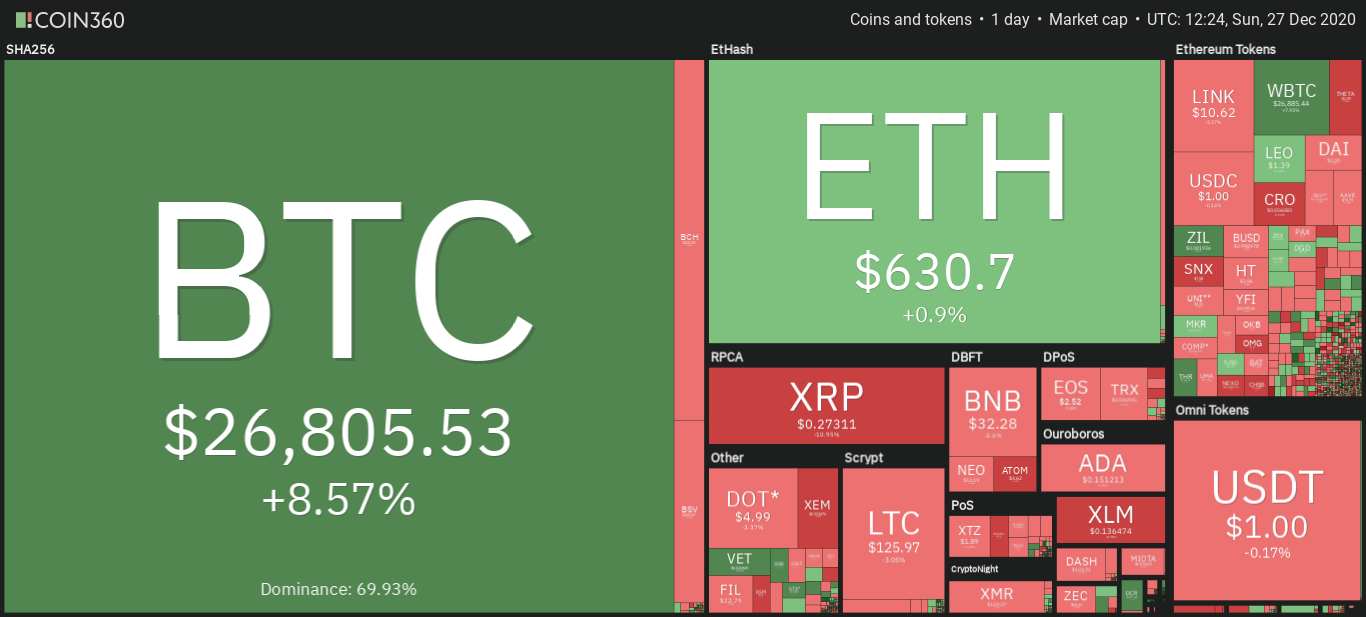

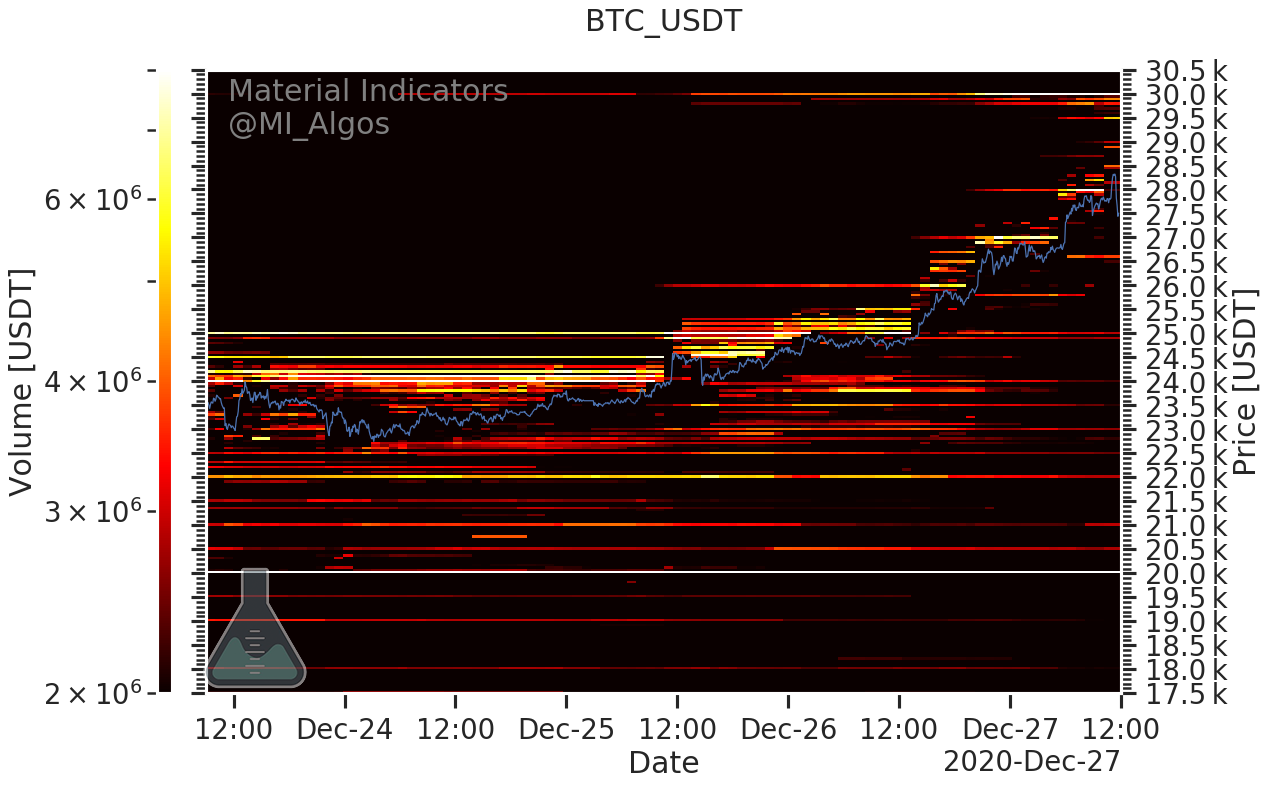

Information from Cointelegraph MarketsAnd the 360 coin And the TradingView BTC / USD showed gains then lost huge amounts in dollar terms during trading on Sunday.

After gaining 15% over a 24-hour period, Bitcoin faced significant selling pressure above $ 28,000. Unable to maintain its very fast upward trajectory, then the largest cryptocurrency fell to $ 26,500.

At the time of publication, the volatility ensured that no steady market trend was taking hold as BTC / USD fluctuated around $ 27,000.

The analyst: “The bullish race of revolutions has begun.”

As Cointelegraph mentioned Earlier in the day, Bitcoin set a number of records with its latest move, including it breaching a $ 500 billion market cap for the first time.

Additionally, Monday should see the largest gap in the bitcoin futures market ever.

This will be the largest CME gap in history pic.twitter.com/IWBsyQsXab

– Sailor Moon Van Club (cryptoSqueeze) December 27, 2020

Since overcoming the $ 24,000 resistance, Bitcoin has traded in uncharted territory with only impromptu sell levels creating imagination in what appears to be an increasingly parabolic market.

As institutional investors take a breather, the talk has turned to retail buyers fueling the final stage of Bitcoin’s rally.

“The bullish cycle has begun to bullish sessions, as more and more players are starting to adopt bitcoin and cryptocurrencies,” Cointelegraph Markets analyst Michael Van de Pope Summing up Twitter Followers.

Van de Poppe continued to look to $ 19,500 as a potential bounce zone, with alternative currencies in line to capitalize on the Bitcoin example once their gains slowed – likely next month.

Meanwhile, Binance’s order book data shows that a massive sell-off wall of $ 30,000 will likely be the next major hurdle for bitcoin bulls.

“Explorer. Devoted travel specialist. Web expert. Organizer. Social media geek. Coffee enthusiast. Extreme troublemaker. Food trailblazer. Total bacon buff.”